Let’s figure out what makes sense for you and your family…

No two families are exactly alike, and good planning shouldn’t be one-size-fits-all. The goal is to put the right pieces in place for your situation—nothing more than you need, and nothing less. Below are a few common scenarios to help you get a sense of what typically makes sense and where to start.

If you own your home…

Owning a home is probably the biggest single investment most people will ever make—and it’s often where planning makes the biggest difference. Putting your home in a revocable trust can help your family avoid the long, costly process of probate. Without a trust, a house can be tied up in court for months—or even years—while fees and legal costs add up. A trust keeps things simple, letting the people you choose take ownership quickly and without unnecessary stress.

You don’t have to be Warren Buffet—or even a millionaire—to make a trust worthwhile. The goal isn’t about having tons of assets; it’s about making sure your home goes to the right hands without drama or delay. A revocable trust gives you peace of mind knowing your home is protected and your family can move forward smoothly.

And it’s not just your primary home. If you have other real estate—vacation homes, rental properties, or land—you can include those in the same trust, creating a single, organized plan for all your property. You still retain full control while you’re alive, and nothing forces you to “lock in” your home forever. It’s flexible planning that works for real people and real homes, not just the ultra-wealthy.

An example of a modest home - my Grandpa Jack’s - that spent years in probate due to improper estate planning (note that his death occurred before I became an attorney- it was not the result of my work!)

If you have significant retirement or investment accounts…

Many families have significant value tied up in retirement accounts, IRAs, or other investments, and planning how those assets are passed along is just as important as planning for your home. Naming a Transfer on Death (TOD) or Payable on Death (POD) beneficiary can help your accounts move directly to the right person without getting tangled up in probate.

In some cases, a revocable trust makes sense—especially if you want to coordinate multiple accounts, manage them during your lifetime, or make sure they pass along seamlessly with other property like a home or business. A trust can also prevent accidental ownership complications or unintended distributions, keeping things simple for the people you care about most.

And here’s the important part: it doesn’t matter how big or small the accounts are—you earned that money, and your loved ones shouldn’t have to fight to keep it. Thoughtful planning ensures your hard work benefits the people you care about, without unnecessary hassle or stress.

If you are married with children…

For married couples with kids, planning is about more than dividing assets—it’s about protecting your family and making sure decisions can be made smoothly if the unexpected happens. A revocable trust can be a great tool if you own a home or other property, helping your spouse manage assets without court involvement and avoiding probate delays. Even if a trust isn’t right for your situation, a will is absolutely essential to make sure your children are cared for if something happens to both parents.

A will lets you name guardians for your children and clearly spells out how assets should be handled. Without one, the court decides who takes care of your kids and how property is distributed—often leading to confusion, delay, and unnecessary stress. Proper planning also prevents your children from accidentally becoming co-owners of your home or other property with your spouse while they’re still minors, which can create legal headaches down the line.

The right combination of trust and/or will ensures that your family is protected, your children are placed with the people you trust, and your property passes in the way you intend. Thoughtful planning now can spare your loved ones a lot of uncertainty and hassle later.

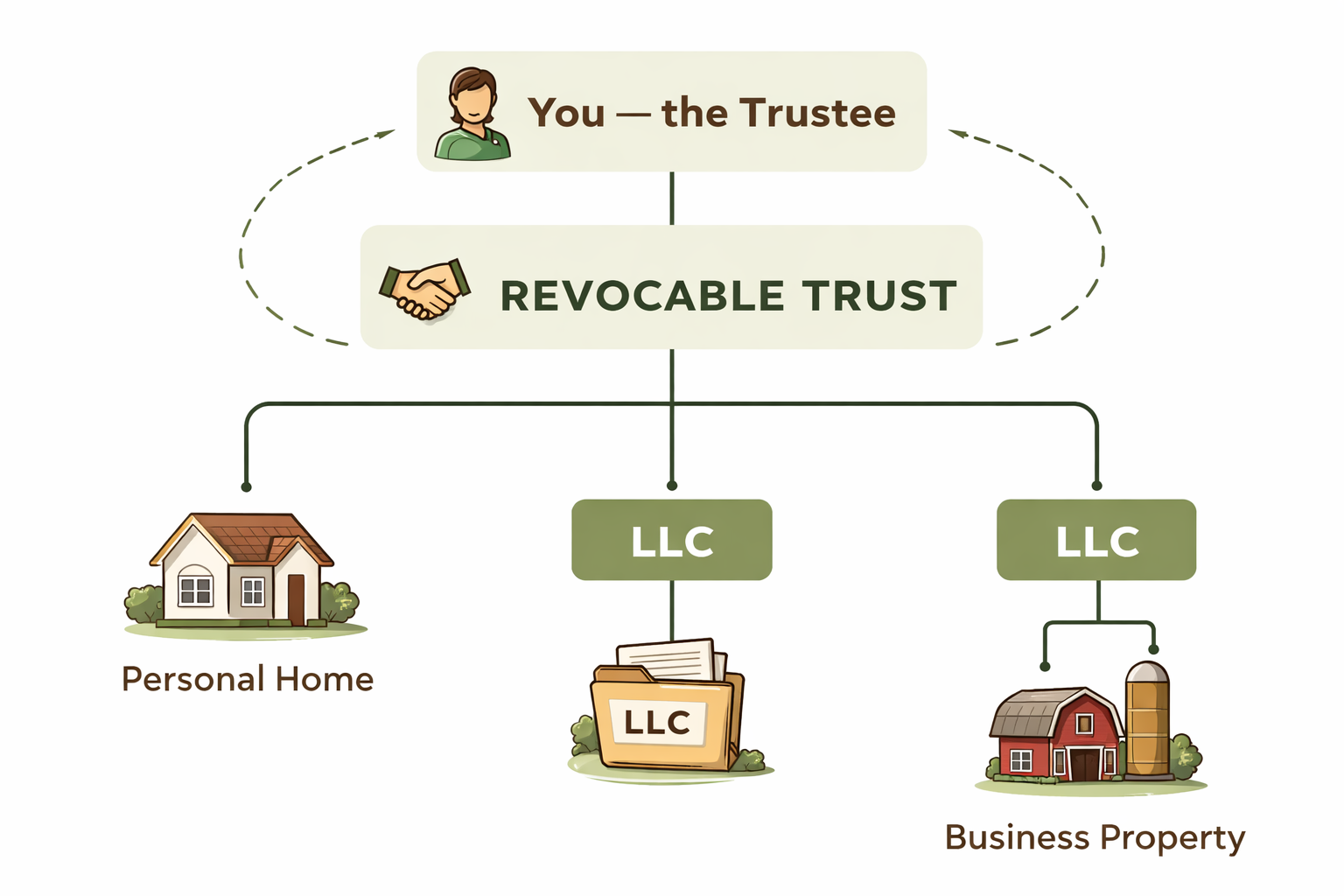

If you own (or co-own) a small business…

Owning a small business adds another layer to planning—your personal and business assets are often intertwined, and you want to make sure both are protected. For many business owners, forming an LLC is a smart first step, as it helps separate your personal assets from business liabilities. But owning an LLC alone isn’t enough to fully protect your family and ensure a smooth transition if something happens to you.

If you already have an LLC—or other business interests—placing them into a revocable trust can be a powerful way to avoid probate and keep ownership clear. Doing so ensures your family or designated successor can step in immediately without waiting for the court to sort things out. This kind of planning is especially helpful if your business is your primary source of income or a major part of your estate.

The goal isn’t to complicate your life—it’s to give you peace of mind. A trust can coordinate your business assets with your personal estate, making it easier for your loved ones to manage everything efficiently, while keeping control in your hands during your lifetime. Even if your business isn’t a massive enterprise, thoughtful planning now can prevent headaches and ensure your hard work continues to benefit the people you care about.

If you’re concerned about what happens when you cannot make decisions on your own…

Nobody likes to think about what happens if they can’t make decisions for themselves—but planning for it is one of the most important things you can do. Powers of attorney let someone you trust step in to handle financial or medical decisions only if you’re unable to do so, even temporarily. These documents do not allow anyone to take your assets while you’re fully capable, nor do they give anyone the power to force you into a nursing home against your will. Fiduciary duties and legal safeguards still apply to protect you.

A financial power of attorney can manage bills, taxes, and other important money matters, while a healthcare power of attorney gives someone the authority to make medical decisions on your behalf—but only when you can’t make those decisions yourself. Both tools work together with a will or trust to create a comprehensive plan that protects your interests and your family without taking away your control.

Even if you’re healthy now, putting these documents in place provides peace of mind—for you and for the people who may need to step in. Thoughtful planning ensures that your wishes are followed, your assets are protected, and your loved ones aren’t left guessing or facing unnecessary stress.

If you’re single…

Being single doesn’t mean you don’t need a plan—it often makes planning even more important. Without a spouse or immediate partner, decisions about your property, healthcare, finances, and even your pets could fall to distant relatives or even the court if something unexpected happens. A will or revocable trust lets you name the people you trust to handle your affairs, so your assets go where you want and your wishes are followed.

A revocable trust can be especially helpful if you own a home, other real estate, or multiple investment accounts. It keeps things simple and avoids probate delays, making it easier for your loved ones to step in and manage your affairs smoothly. Even if a trust isn’t needed, a will ensures that decisions about your property and guardianship (if applicable) are clear and legally recognized.

The key is having a plan that fits your situation, no matter your age or net worth. Thoughtful planning now gives you control, protects your loved ones, and keeps your affairs out of court—so your hard work and assets go exactly where you intend.

Frequently Asked Questions:

Trusts, Wills, & POA’s

Q: What is the most ‘ideal’ estate plan for a typical family?

A: For most families, an ideal estate plan is built around a revocable living trust that owns their land and major assets. While the parents are alive and capable, they serve as the trustee (or co-trustees) and remain the beneficiaries, meaning everything in the trust is still for their benefit.

If the parents become unable to manage things, the children usually step in as contingent trustees. Their role is to act in the parents’ best interest—not their own. When the parents pass away, the trust continues without going through probate, and the assets are distributed according to the trust. If a child has already passed, that child’s share typically goes to their children.

Most plans also include a pour-over will as a backstop, in case something ends up outside the trust, along with powers of attorney and health care directives to handle financial and medical decisions during life. A separate memorandum is often used for personal or sentimental items.

The goal is straightforward: stay in control while you’re alive, avoid court when you’re gone, and make things as easy as possible for the people you leave behind.

Q: Do I need a trust if I already have a will?

A: A will by itself only controls what happens after death, and anything passing under a will must go through probate. A trust, on the other hand, can own assets during your lifetime and allows those assets to pass outside of probate, which is why many families use both together.

Q: Do I need a trust if I already have an LLC?

A: Yes—having an LLC and having a trust serve different purposes. An LLC protects you from liability, keeping your personal assets separate from business risks, but it does not avoid probate. A revocable trust, on the other hand, allows your LLC ownership (and other assets) to pass to your heirs without going through probate. If you want to make sure your property and business interests transfer smoothly and stay out of court, a trust is usually a smart addition even if you already have an LLC.

Q: Do I need a trust if I don’t have a large estate?

A: Even if your estate isn’t huge, a trust can make a big difference if you own land or have an LLC. These types of assets can take a long time to go through probate, and a trust helps keep things simple and in your family’s hands. At the end of the day, you will either pay a reasonable amount for a revocable trust OR your loved ones will pay potentially exorbitant amounts for probate and spend months if not years trying to get your assets out of probate.

Q: When should I update my estate plan?

A: For most families, you only need to update your plan if something unexpected happens. That could include a trustee or executor passing away, a beneficiary dying early, or if you want to make sure someone receives or does not receive something you originally listed. These situations are fairly rare for families who simply want their children to inherit equally.

Trusts make updates especially easy. You can usually make changes without rewriting the whole document, unlike a will, which must be re-executed in full each time. This flexibility helps your plan stay current while keeping costs low.

Q: How can I make sure a special family item goes to the right person?

A: Yes. For items with sentimental value, like an engagement ring, a family heirloom, or a favorite rifle, I include a TPP (tangible personal property) memorandum with every will I prepare. This separate list lets you specify who should receive each item without having to rewrite the entire will, making it simple to keep your wishes clear and up to date.

Q: What’s the difference between a revocable and an irrevocable trust?

A: A revocable trust can be changed, updated, or even revoked while you are alive, which makes it flexible for most families. An irrevocable trust generally cannot be changed once it’s created, which can make managing or selling assets difficult. For my clients, I almost always recommend a revocable trust because it allows you to sell or manage property easily while still providing the benefits of a trust.

Q: How long does it take to complete a standard estate plan?

A: A typical estate plan usually involves two meetings. The first is a preliminary meeting to go over your assets and goals, which can often be done over the phone if distance is an issue. The second is a signing ceremony after I draft the documents. Most clients don’t need major revisions afterward, and if changes are ever needed in the future, they are usually quick and inexpensive to make.

Contact me

Interested in working together? Fill out some info and I will be in touch shortly. I can’t wait to hear from you!