The Ideal Farm Succession Plan in 2026

Things to Know Before You Read

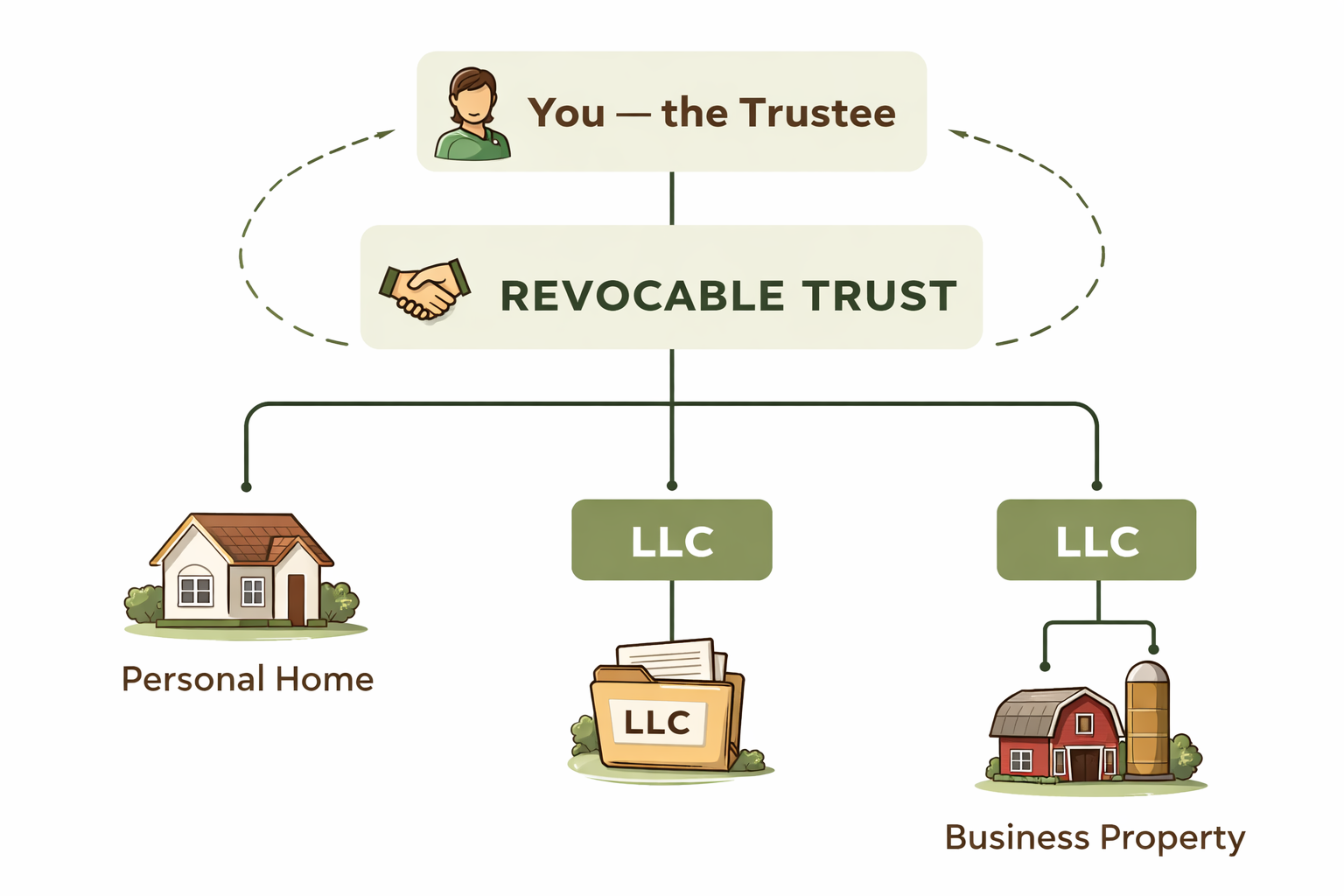

If you’re a farm owner in 2026, you don’t need complex legalese — you need a succession plan that is easy to understand, easy to execute, and legally solid. This post breaks down the structure most farm families should consider: why a revocable trust sits at the center, how LLCs secure business land, what supporting documents you need, and how to handle situations when not all kids want to farm. You should walk away with a step-by-step framework and clear next steps if your current plan isn’t serving you.

Start With One Revocable Trust (The Foundation)

The backbone of a straightforward farm succession plan in 2026 is a revocable living trust.

Here’s how it typically looks:

Parents: trustees and current beneficiaries

Children: contingent beneficiaries

Put everything of value into the trust — not in mom and dad’s personal names. That means:

The trust owns the LLCs

The trust owns personal land outright

Why this matters:

Avoids probate

Keeps ownership centralized

Makes updates easier as life changes

Simple rule: One trust at the top — everything flows through it.

Place Farm Business Assets in LLCs

If it’s part of the farming business, it should be in an LLC that the trust owns.

Common examples include:

Grazing pastures used for cattle or livestock

Cropland used for row crops or hay production

Land with barns, poultry houses, or equipment sheds

Shop sites and storage yards

Any tract primarily used to generate farm income

This structure:

Separates business risk from personal and family land

Helps protect non-business property from lawsuits or creditors

Makes transitions smoother (you transfer LLC membership interests, not deeds)

In plain terms:

The trust owns the LLC. The LLC owns the working farm ground.

This keeps your operation organized today and far easier to transition tomorrow.

Don’t Forget the Supporting Documents

A trust alone isn’t enough — you need a few backup pieces so there are no gaps:

Pour-over wills — anything left out gets pulled into the trust

Powers of Attorney (POAs) — someone can act if you become unable

Health Care Directives — no guesswork if health decisions need to be made

These aren’t optional extras — they protect you and your family from common gaps that come up when something unexpected happens.

What If Not All Kids Want the Farm?

This is one of the most realistic questions farm families face.

Here’s how to handle it without drama:

Buy-Out Plans

If one child wants to take over:

Set rules now for how they buy out siblings

Decide how value is determined

Establish timing and payment terms

This keeps expectations clear and prevents conflict later.

Life Insurance

Life insurance can provide cash to siblings who don’t want to farm — so:

The farm stays intact

Inheritance is fair and manageable

No one has to sell land to pay out siblings

Pro tip: Many families also think about estate taxes here — but that’s a deeper topic for another article/video.

Simple framing: Keep land with the farm, give cash to the kids who don’t want it.

The Most Common Mistakes That Make Farm Plans Complicated

Most messy farm succession plans do not start out messy. They become complicated because of a few common beliefs and piecemeal decisions that seem harmless at the time.

Here are the biggest ones I see:

“My kids will figure it out when I’m gone.”

They usually will not. Confusion, disagreements, and delays are almost guaranteed. Kids are left trying to interpret old deeds, outdated wills, and verbal promises while dealing with grief.

“This is the way we’ve always done it.”

Keeping land in personal names, relying on a simple will, or doing nothing might have worked decades ago. Today, with land values higher and operations more complex, those old methods create probate issues, tax exposure, and unnecessary liability.

Doing a piecemeal plan.

This is one of the most common traps. Families might start with a simple will, then form an LLC for part of the operation, then change a deed, and finally realize a trust is needed. Each step alone seems reasonable, but together they often conflict, leave assets outside the correct structure, and create gaps no one notices until it is too late. It is almost always better to design the full plan first and implement it all at once. A single plan is a lot cheaper both on the front end and back end. It also helps everyone sleep better at night when the family is on the same page.

No powers of attorney or health care directives.

Families assume a spouse or child can just step in. Without these documents, someone often has to go to court just to pay bills or make medical decisions.

No real plan for kids who do not farm.

Without a buy-out plan or life insurance in place, families end up trying to be “fair” by dividing land, which usually hurts both the farm and family relationships.

Allowing things to go through probate.

Probate is often messy, very public, and very expensive. It can slow down transfers, create unnecessary conflict, and put the family’s privacy at risk. Avoiding probate through a trust keeps the plan private, controlled, and far simpler to execute.

None of these mistakes look dramatic on paper. They only become serious problems when someone dies or becomes incapacitated and then it is too late to fix them.

Future blog posts will cover the common lies that drive these mistakes, like “my kids will figure it out” and “this is the way we have always done it,” and explain why they are so damaging.

Why Simple Plans Work Better for Farm Families

After years of seeing what holds up and what falls apart, one thing is clear: simple plans last, complicated plans break.

Here is why simplicity matters:

Families understand it. If your family cannot explain the plan without the lawyer in the room, it is too complicated.

It is easier to maintain. Life changes, crops change, kids’ roles change. Simple structures are easier to update.

Fewer moving parts means fewer mistakes. One trust, LLCs underneath it, and clear rules is all that is needed.

It actually gets followed. When the time comes, a simple plan is more likely to be carried out the way you intended.

It avoids probate. By keeping assets in a trust and LLCs, the plan is private, controlled, and far cheaper and smoother than letting things go through probate.

A single, well-structured plan is cheaper both upfront and over time. It also helps everyone sleep better at night because expectations are clear and everyone knows what will happen.

Farm families do not need clever legal tricks. They need a plan that is clear, organized, and hard to mess up when emotions are high. That is why the trust plus LLC structure works so well. It keeps everything in one place, easy to manage, and easier to transition when the time comes.

Learn More and Get Started

If your farm succession plan isn’t structured clearly or you can’t explain it at the kitchen table, it’s time to get professional guidance. Contact our office today to set up a consultation and make sure your plan is simple, complete, and protective of your farm and family.

For more practical advice, examples, and tips, check out my social media channels where I regularly share short videos and insights on farm succession planning. I hope these videos let you get to know me and my approach a little better. If they do, I hope you’ll trust me enough to send a message and get an evaluation of your potential succession plans.